Create your very own Auto Publish News/Blog Site and Earn Passive Income in Just 4 Easy Steps

Yes, it is possible to get a student loan despite having little or no credit.

If you're young, you may not have enough credit history to qualify for certain types of loans. But don't worry! It's still possible to pay for college with a student loan.

On the other side of the spectrum, sometimes the early decisions we make about money come back to haunt us. Let's say you get a credit card at 18 and then don't pay your bills. This can hurt your credit score early on and make it difficult to get more credit later. And even though you've learned from your mistakes, that small transgression can haunt you for a long time.

So what happens if this applies to you and you need a student loan? Can you get a student loan with bad or no credit?

Before you embark on the adventure, be sure to check out the best student loans to finance your studies.

Let's explore your options!

Need-based government student loans

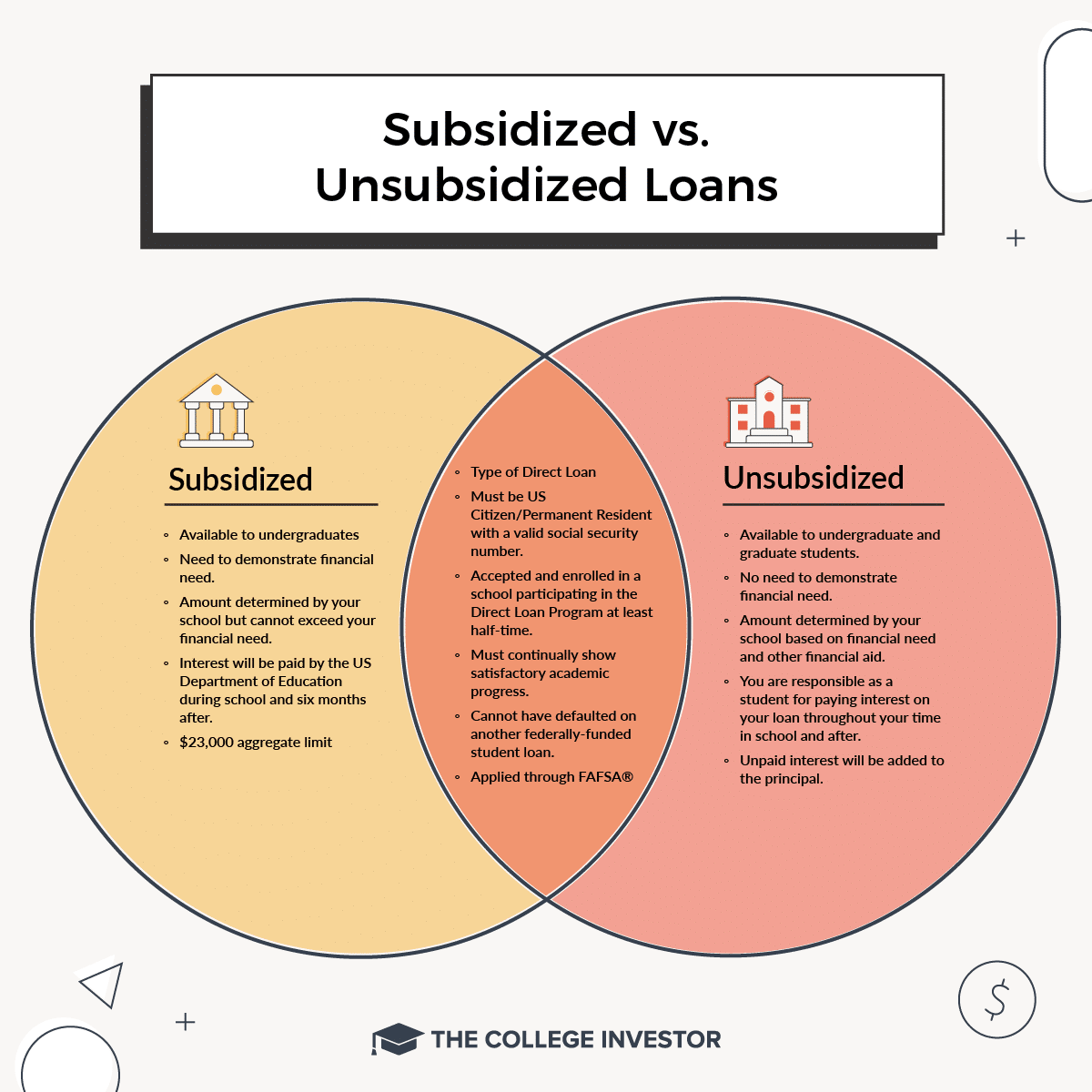

The best option for student loans, whether you have good or bad credit, is need-based federal student loans. Need-based student loans are based on eligibility requirements that are calculated when you fill out the FAFSA application. The FAFSA application takes a lot of information from your taxes (and your parents' taxes) and runs it through a formula that calculates what's called your expected family contribution (or basically how much you can theoretically afford for college).

Once this amount is calculated, you can determine if you are eligible for need-based student loans. Right now, that means you will receive:

These loans are ideal for students with bad credit because your credit score is not a factor used to calculate eligibility, so even if you have bad credit, you may be able to qualify for this type of loan.

Non-need-based government student loans

If you do not have a need according to the Student Aid Index formula, you may still be able to receive federal student loans that not require a credit check.

You can get one of the following:

- Direct, unsubsidized federal loans

- Federal Grad PLUS Loans

These loans typically allow you to borrow larger amounts and they are also not dependent on your credit score, so even if you have bad credit, you can still qualify for these loans. Your school's financial aid office can help you with this.

You can find the best interest rates for student loans here >>

Federal loans that require a credit check

The only notable exception to government loans are PLUS loans for parents. We've talked at length before about how we don't believe parents should borrow money to pay for their children's education, but the fact is that many parents do it anyway.

Parent PLUS loans are not based on credit scores like traditional loans – and they do not base your qualifications on your credit score. However, to qualify for a Parent PLUS loan, you must not have a negative credit history. This means in particular that you must not have:

- A current insolvency

- More than $2,085 in delinquencies or write-offs in the last two years

- Any default, bankruptcy, foreclosure, repossession, tax garnishment, wage garnishment, or forgiveness of federal student loan debt in the past five years

Sometimes you can get around these requirements by appealing (rare) or finding a co-signer with a positive credit history (more common).

However, keep in mind that we NEVER recommend parents to take out a loan for their child's education.

Private student loans

Finally, there are private student loans. Most borrowers should avoid these loans unless you have a very specific reason for doing so (e.g., medical school).

If you have bad credit, it can be difficult to get a private student loan. Unlike government student loans, private student loans are Do Look at your credit score. If your credit score is low, the bank may require you to have a cosigner on your student loans. Find options for student loans without a cosigner here.

If you don't have someone who can co-sign for you, you probably won't be able to get a private student loan if you have bad credit.

For more information, see our list of the best private student loans for students.

Know your credit score

The key to all of this is to simply make sure you know your credit score at all times. If you need to take out a loan, you should know what you can and cannot qualify for based on your score. Also, knowing your credit score is essential if you want to take out other loans despite having low credit.

That's why I recommend everyone to use a free service like Credit Karma to check their credit score. Credit Karma is really free and you don't need a credit card or anything like that to sign up. When you sign up, you can see your credit score and other tools to help you improve your credit score. You've probably seen their commercials on TV and I use them myself.

What do you think about taking out a student loan despite having a low credit rating?

Create your very own Auto Publish News/Blog Site and Earn Passive Income in Just 4 Easy Steps