Create your very own Auto Publish News/Blog Site and Earn Passive Income in Just 4 Easy Steps

Moby gives you a head start by providing access to world-class investment research, broken down into understandable formats. For active investors looking for a jargon-free platform, Moby could be the right solution.

Because if you want to actively manage your investment portfolio, regular trading in individual stocks can be a part of your life. To do business efficiently, you need to stay up to date on a seemingly endless body of information.

We will examine how Moby could help you manage your portfolio more efficiently.

- Moby offers a range of colloquial research to help you manage your investment portfolio.

- You can access information in written, video and audio formats.

- It costs $179 for the first year, then $199 per year thereafter.

|

Investment analysis and stock selection via newsletters and podcasts. Market alerts, industry rankings and political trade tracking. Trading courses are also available. |

|

|

$179 the first year, $199 per year thereafter |

|

|

30 day money back guarantee |

|

What is Moby Finance?

Moby was founded in 2021 by Dan Remstein and Justin Kramer. It is a mobile-friendly investment research platform designed to help you stay on top of an ever-changing market. Moby focuses on stocks and cryptocurrencies.

What does it offer?

Moby is an investment research platform working to make investing more accessible to the masses. Unlike other investment research platforms (Motley Fool in particular), Moby makes understanding investments very easy, without aggressive upsells or paywalls.

Jargon-free research

When it comes to actively managing an investment portfolio, most investors have to wade through jargon-filled reports to make the most of their trading opportunities.

For most, the jargon-filled world of investment analysis can be overwhelming. Helpfully, Moby promises to offer expert analysis without the jargon. The simple breakdown can help you get the information you need without spending too much time deciphering the jargon.

Optimized information

Moby makes it easy to keep track of the market.

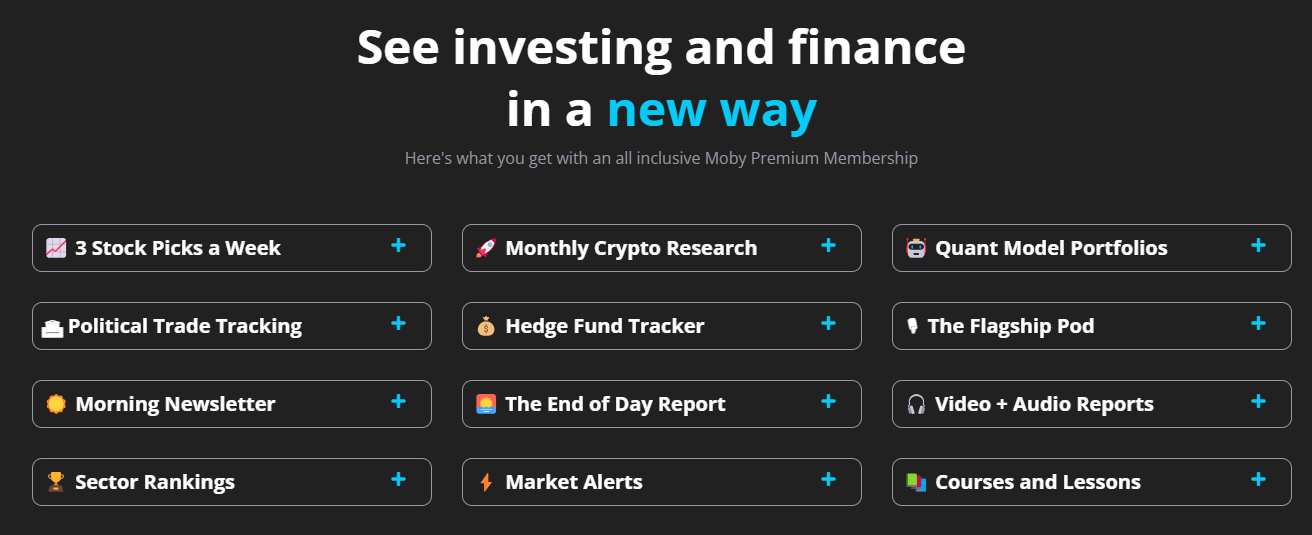

One way Moby provides a streamlined experience is by providing three stock picks each week. As a Moby member, you get access to a list of top stock picks selected by a team of former hedge fund analysts, with an emphasis on value stocks with strong growth potential. Moby's recent successful stock picks include Alcoa, Tesla, Moderna and Asana, all of which achieved returns in excess of 500%.

Other tools to help you gather information efficiently include a morning newsletter, monthly crypto research reports, end-of-day reports, and regular market alerts.

Another interesting piece of information is Moby's Political Trade Tracking. Essentially, this tool tracks what deals incumbent politicians make in the United States. The weekly update can help you keep an eye on what deals influential politicians are making.

The downside is that Moby misses out on some of the tools investors might want. For example, there is no portfolio analysis tool or watchlists.

Available in multiple formats

Written reports on investment research can be helpful. However, if you don't have time to sit down and read a report or just want to mix things up, you'll appreciate that Moby offers investment research insights in multiple formats.

In addition to written information, video and audio reports are also available. The platform also offers a weekly podcast that contains investment insights.

The variety of formats allows you to stay on top of the information you need without having to constantly read updates.

Educational resources

Actively managing an investment portfolio is not always easy. It helps build your skills along the way, which Moby supports by providing courses and lessons to expand your knowledge.

The platform offers educational resources to help you expand your knowledge. Whether you want to learn investing from scratch or take your skills to the next level, Moby has resources for you.

How does performance compare?

That's the question almost everyone asks – but it's a tricky question. Comparing the performance of different stock picking platforms isn't particularly helpful, as they all use their own timing and metrics (and it's unlikely that you as a customer will be able to replicate them).

But performance is important – so how does Moby focus on performance? They will highlight long-term buy-and-hold investments and give you a specific price target. When this goal is reached, you will receive a notification. Sometimes this warning is an exit, but sometimes it is an increase in the price target.

Are there any fees?

Moby is a paid platform that costs $199 per year. At the time of writing, Moby was running a special offer that gives you 10% off the first year, bringing the annual cost down to $179.

If you sign up to the platform and find that the platform is not what you are looking for, you can take advantage of the money-back guarantee. The company will refund you the full amount if you submit the application within 30 days of registration.

How does Moby Finance compare?

Moby isn't the only investment research platform out there. Here's how it stacks up:

At $249 to $2,995 per year, Zacks Stock Research is a little more expensive than Moby. The platform offers a number of tools, including a stock screener that provides filters to help you find ideal stocks for your portfolio. Additionally, Zacks uses a straightforward ranking system to make your life easier.

The Colorful fool is another option that costs $99 for the first year, after which the price increases. Like Moby, The Motley Fool offers stock-picking tips delivered to you each month in a newsletter. The platform also offers access to a community of investors. However, The Motley Fool is known for its aggressive marketing and paywalls – meaning there are upsells to access everything.

|

Headers |

|

||

|---|---|---|---|

|

$179 the first year, $199 per year thereafter |

|||

|

30 day money back guarantee |

30 day money back guarantee |

||

|

cell |

How do I open an account?

If you would like to work with Moby, you can open an account by clicking “Get Started” on the website, providing your email address and creating a password. From there you will be asked to pay by card or PayPal. Once your account is created, you can immediately start using the platform's tools.

Is it safe and secure?

When you use Moby, you have the option to pay with credit card or PayPal. In any case, your payment information is reasonably safe on the platform.

The company's privacy policy states that it may anonymize your personal information and share it with third parties. In addition, it may share your information with business partners.

How can I contact Moby Finance?

If you would like to get in touch with Moby, you can send a message through the company's website. According to the message box, someone from the company will usually get back to you within four hours.

Regarding their experience, Moby's Trustpilot rating of 4.6 out of 5 stars seems to indicate that most customers had a positive experience. So far, the company has earned 3.8 out of 5 stars on the Google Play Store. However, since the company is relatively new to the market, there are only a limited number of customer reviews available.

Is it worth it?

If you want to work with a platform that offers optimized information about the stock market, Moby may be the right choice.

This is particularly useful for new investors who are just learning the ropes and familiarize yourself with active trading. But more experienced investors may prefer to do their own stock analysis.

Check out Moby here >>

Moby financial features

|

|

|

$179 the first year, $199 per year thereafter |

|

|

Web/Desktop Account Access |

|

|

30 day money back guarantee |

Create your very own Auto Publish News/Blog Site and Earn Passive Income in Just 4 Easy Steps